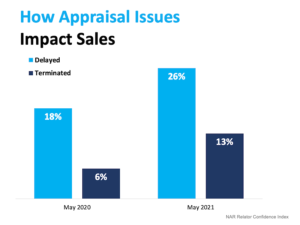

Key Takeaways: The combination of low inventory and high demand is creating an unprecedented amount of appraisal gaps in today’s ultra-competitive market. Appraisal gaps occur when the price of your contract doesn’t match up with the appraised value of your home. Appraisal gaps impact every aspect of your real estate transaction, from the financing to […]

Tag Archives: home financing

Putting 20% Down Doesn’t Mean What It Used To

Key Takeaways: Many home buyers are under the impression that they have to have a 20% down payment to purchase a home. Statistics actually show that recent homebuyers have been putting down less than 20% for a down payment and are still able to buy the home of their dreams. Don’t let the myth of […]

Appraisal or Home Inspection—Do You Really Need Both?

Key takeaways: A potential buyer should get both an appraisal and inspection in order to ensure they are paying the correct price for their potential home. An appraisal represents the value of the home, whereas an inspection evaluates the home’s overall condition. Want an expert’s help in determining what to offer for your dream home? […]

Surging Home Values Still Allow for Affordable Homes

Key points: The current housing market is heavily geared towards sellers, and high demand for homes can lead to competitive prices for home buyers. Historically low mortgage rates are contributing to the affordability of today’s homes because homeowners will pay thousands less in interest over the lifespan of their loan. Want to take advantage of […]

Why Every Buyer Should Get Pre-Approved Before Searching for Homes

You may have heard that getting pre-approved for a mortgage is the most important step you can take before buying a home. But unless you’ve done your research, you probably aren’t aware of all the amazing benefits that come with having a pre-approval letter in hand. Why You Shouldn’t Skip Getting Pre-Approved for Your Mortgage […]